By now, you may have heard of payment reconciliation and still not have a piece of in-depth knowledge about it. In this all-inclusive guide, we aim to dispel the mystery of payment reconciliation and how to achieve an error-free process.

What is payment reconciliation?

Say you own an eCommerce store that sells essential goods. First, you may need to have a thorough understanding of your cash flow and expenditure so that you know how much profit you are making. Eventually, it will help you chalk out a business plan. This is what payment reconciliation means.

In a nutshell, reconciling your payment means cross-checking your cash flow and business expenditure.

With the rise of fintech companies, the business landscape has taken a new shape where companies are using payment gateway dashboards for payment reconciliation. These dashboards are designed to help them get a close look at their payment analytics. For instance, merchants can analyze the most popular payment method mode or even net transaction amounts. Subsequently, this data can be used to optimize your marketing initiatives to boost sales and revenue.

How does reconciliation work?

The process of payment reconciliation unfolds in two stages, including:

- Internal: The business records a transaction in its accounting software or via its desired record retention system. They may also save invoices, receipts and billing paperwork.

- External: The bank records the transactions as they are processed. After that, it makes a statement available to the businesses mentioning vital information like payer, payee, payment amount, method and date.

Lastly, internal and external records are reconciled once the business confirms that both internal and external activity matches.

Why do you need to reconcile transactions regularly?

Reconciliation is not something you can afford to ignore. In fact, it is a crucial chore on your to-do business list that aims to protect your business, improves your cash flow, and maintains compliance.

Here is why you should consider reconciling your payments from time to time:

- It helps you unfold errors and unauthorized payments

Reconciliation helps your business stay in tune with your finances. You can unfold errors sooner than later once you compare the internal and external records. Thus, it helps you ensure a faster resolution and improved income. Plus, you will be able to identify any unauthorized payments or security breaches.

- It helps ensure your business’s financial records are genuine

Without accurate records, you cannot maintain the health of your business, make informed decisions and demonstrate your financial situation to banks and lenders.

- It helps you spot unpaid or late invoices

Imagine that you have sent the invoice record out but did not receive the funds. Now when you choose to reconcile payments regularly, you ensure every missed or delayed invoice has been followed up and settled.

Understanding high-risk reconciliation

High-risk reconciliation is associated with high-risk transactions. Essentially, high-risk transactions have higher chances of disputes or chargebacks. It is the payment gateway or the bank that can mark a transaction as high risk. Subsequently, the settlement to such a merchant is put on hold until the issue is fixed. Eventually, this leads to a delay in payment reconciliation and hence called high-risk reconciliation. A merchant can be considered high risk because of its industry or the low financial integrity of its earlier transactions.

Why does payment reconciliation seem such a challenge?

Despite the fact that payment reconciliation is a simple process, it involves a great many challenges faced by data analysts and accountants while reconciling the transactions. First, the reconciliation reports are sent to merchants entailing all the transactions being processed by them, including the fees applied. These reports are then utilized by the accountants to match against bank statements or transaction records.

However, payment reconciliation does not have to be such an arduous task. Nowadays, businesses are exposed to a number of tools that are meant to make reconciliation as painless as ever!

Reconciling your payments with payment gateway

The Indian payment gateway industry is expected to grow to 1.71bn US dollars. With that said, more and more merchants continue to seek the best online payment gateway in India for reconciling their payments.

Here are a few benefits of reconciling payments with payment gateways:

- Real-time reconciliation

Reconciling payments in real-time allows merchants to get the definite status of the transaction, eliminating the uncertainties pertaining to payment delays. It is like a lifesaver for businesses with dynamic prices.

- Payment analytics

For all established and burgeoning businesses alike, one thing is clear. Business growth depends on current cash flow. Now, payment gateways offer detailed analytics and reporting capacities. Therefore, they help merchants make informed business financial decisions.

- User-friendliness

In all, payment gateways make reconciliation a cakewalk for users. Merchants are able to view every transaction with a unique reference ID. Plus, they can also get access to information such as transaction amount, settlement, and MDR.

The payment gateway dashboard serves as the platform with all the information on every refund, settlement cycle, vendor payment, payment link transaction and whatnot.

Lastly, in events of errors or disputes, payment gateways can help you resolve the issue with their dedicated account managers and features like LIVE chatting.

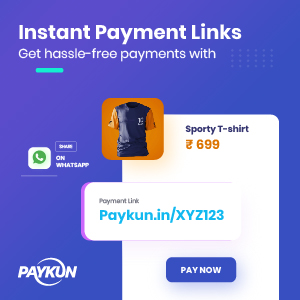

Are you interested to take the leap?

Would not it be great if the reconciliation could be done in a matter of a single click? PayKun offers automated payment reconciliation as part of its payment gateway service. Please visit our website for further information on this.